SUPERAGENT AI Launches Universal Integration Ecosystem to Connect AI Agents with Major Insurance Platforms

SAN FRANCISCO, CA, UNITED STATES, February 17, 2026 /EINPresswire.com/ — New update enables autonomous data synchronization across top CRM, AMS, and telephony systems, streamlining agency workflows.

SUPERAGENT AI, Inc. today announced the launch of its Universal Integration Ecosystem, an expansion designed to address connectivity challenges between mission-critical systems in the insurance industry.

Historically, insurance agencies have utilized distinct software ecosystems that may lack native integration. This fragmentation often requires producers to manually transfer data between Customer Relationship Management (CRM) systems, Agency Management Systems (AMS), and dialers. The new Universal Integration Ecosystem aims to automate these processes.

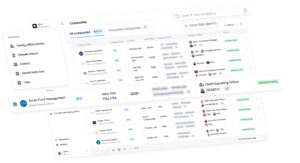

Through a new agnostic integration layer, SUPERAGENT AI connects its workforce of Autonomous AI Agents to a wide range of external platforms. The system now supports integration with industry providers including Salesforce, AMS360, Applied Epic, EZLynx, AgencyBloc, HawkSoft, and Better Agency, allowing disparate tools to function as a unified stack.

“A primary challenge in insurance technology is interoperability,” said Vlada Lotkina, CEO of SUPERAGENT AI. “Agencies often have to balance between software compatibility and feature sets. Our goal with this launch is to remove that compromise. The Universal Integration Ecosystem enables our AI Agents to function within an agency’s existing technical stack, updating systems autonomously.”

Enhanced Connectivity Features

The Universal Integration Ecosystem allows SUPERAGENT’s AI workforce, including the Quoting, Retention, and Live Call agents, to read and write data across an agency’s infrastructure.

Universal AMS/CRM Synchronization: The AI autonomously logs activities, updates policies, and creates contacts across systems such as HubSpot, Zoho, Novi AMS, and AgencyZoom. This capability is designed to improve data accuracy and reduce manual input.

Telephony Integration: The platform now natively integrates with major voice providers including RingCentral and Twilio, allowing the AI to listen, log, and analyze calls regardless of the carrier.

Expanded Application Compatibility: Beyond the 30+ native integrations available immediately, the platform’s open architecture connects with productivity applications ranging from Google Sheets and Slack to Notion, providing agencies with extensive integration options.

Streamlining Agency Operations

This release positions integrations as a core capability of the SUPERAGENT platform.

“We approach integration as a fundamental requirement rather than an add-on,” said Vadym Shashkov, CTO of SUPERAGENT AI. “We have developed a system where data flows from lead forms to CRMs, to our Insurance AI Agent, and back to the AMS. This reduces the ‘swivel chair’ workflow of switching tabs and re-typing data.”

Availability

The Universal Integration Ecosystem is available starting today. Agencies can deploy SUPERAGENT AI on top of their existing technology stack without replacing current software.

About SUPERAGENT AI

SUPERAGENT AI is a provider of autonomous workforce platforms for the insurance industry. With a suite of specialized AI agents that handle training, quoting, retention, and sales, the company delivers solutions designed to automate the insurance agency lifecycle.

Sheny Plasencia

SUPERAGENT AI, Inc.

+1 415-423-0940

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

We Don’t Slow Down: SUPERAGENT AI Integrations Special Event

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()